16+ Fha down payment

The FHA limits the amount of the loan you can get. Homebuyers were guaranteed 80 financing in exchange for a 20 down payment.

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

This may be a good mortgage choice if youre a first-time buyer because the requirements are not as strict as for other loans.

. Theres an 8000 down payment mortgage grant available for folks in the Raeford Aberdeen Angier areas of NC that carries no payment and accrues no interest. If the borrower has a lower score 500-579 the minimum down payment is 10 percent. If you can make a 10 down payment your credit score can be in the 500 579 range.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Those whose credit scores fall. DOWN PAYMENT ASSISTANCE MAY BE.

Here is an example of how factors such as creditworthiness impact the cost of mortgage insurance. Down Payment Assistance In Raeford NC Mortgage Grants. We are thankful that we.

The Federal Housing Administration FHA manages the FHA loans program. One drawback of FHA loans is they require mortgage insurance regardless of your down payment amount. Move in for a Year.

But more likely youre looking at a down payment between 5-25. First-time home buyers make a median down payment of 7 on their home. Some conventional lenders will accept down payments as low as 3 but youll most likely need to purchase private mortgage insurance PMI to secure the loan.

Lenders typically require a down payment of at least 20. Credit scores dont just affect mortgage and homeowners insurance rates they also affect PMIS. How Credit Scores Affect the Cost of PMI.

Mortgage Type Loan Limits. The down payment and closing costs are low. If you fall into the 500 to 579 range you will need to put down 10.

An FHA loan requires a minimum 35 down payment for credit scores of 580 and higher. They may view it as a way to make an impact while still being able to see the. Affordable payments wgood credit.

4 of 16. Am I eligible for an FHA loan. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify.

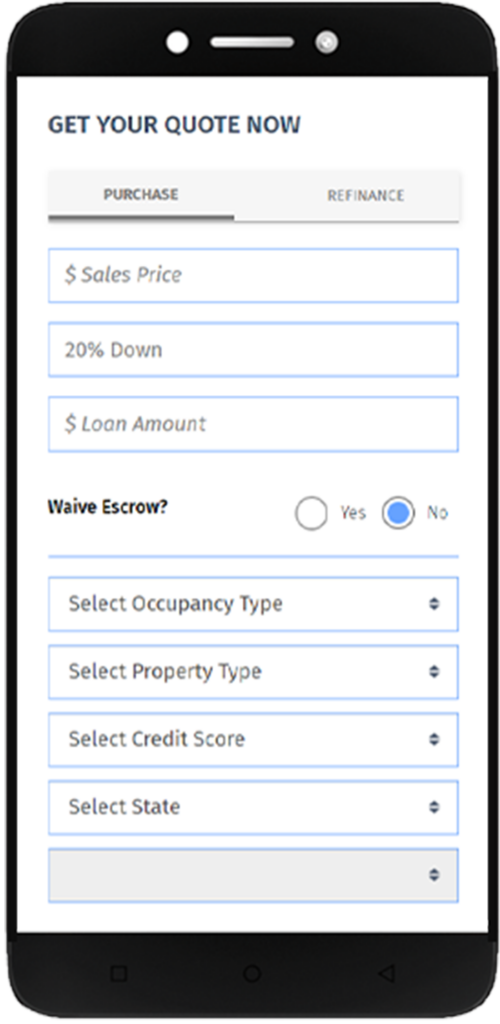

Apply for an FHA Loan Today. Browse through our frequent homebuyer questions to learn the ins and outs of this government backed loan program. How much house can you afford.

We use live mortgage data to calculate your mortgage payment. Calculate your mortgage payment. Try these strategies for the lowest down payment on an investment property possible.

So for a 100000 mortgage youd need a down payment of 20000 excluding closing costs and taxes. Rocket Mortgage requires a minimum credit score of 580 for FHA loans. 62 of Americans believe a 20 down payment is necessary though most mortgage loans require less than 5 down payment.

The average down payment is higher. We have built local datasets so we can calculate exactly what closing costs will. FHA loans are the 1 loan type in America.

Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment. Under the new FHA mortgage insurance rules when you use a 30-year fixed rate FHA mortgage and make a down payment of 35 percent your FHA mortgage insurance premium MIP is 085 annually. FHA mortgage applicants with credit scores as low as 580 may be approved for a home loanprovided that they have enough to cover the 35 down payment requirement.

Repeat home buyers make a median down. How to buy a house with no money down. 1 min read Mortgages.

134 million Americans were approved for a single-family mortgage in 2020 a 1126 percent increase from 2018. You must qualify for a loan with an FHA-approved lender. We assume a 30-year fixed mortgage term.

The FHA also recommended extended fixed-rate terms which eventually gave rise to the 30-year fixed-rate mortgage. Low 35 Down Payment Requirements Credit Score Requirements as Low as 580. 356362 is the limit in low-cost areas and 822375 is the limit in more expensive areas.

Paying down a mortgage at 4 per year can be a better deal. Whats driving mortgage rates the week of Sept. The rates for this first time home buyer program are determined by the NC Housing Finance Agency.

Using a mortgage calculator is a good resource to see what a different monthly payment might. To qualify for a 35 payment on an FHA loan youll need at least a 580 credit score. August 16 2022.

A mortgage calculator can help you estimate your monthly payments and you can see how your down. 16 percent of the purchase price. An estimated 16 of homebuyers obtained FHA loans in 2020 according to a report by the National Association of Realtors NAR.

In fact 16 of all buyers received a gift or loan towards their down payment from a friend or relative in 2019sup1sup Some with the ability to comfortably make a down payment gift without hurting their retirement decide to help their kids become homeowners. Purchase or refinance your home with an FHA loan. FHA loans have other costs.

FHA Loans. With a score between 500 and 579 youll need a 10 down payment. The most recognized 35 down payment mortgage in the country.

We use mortgage loan limits down to the county level to identify if a user qualifies for an FHA or Conforming loan. You can get one with a down payment as low as 35. Consider two individuals who each want to buy a home valued 100000 and can each put down 10000 or 10 of the value of the.

With a score between 500 and. 9 Ways to Lower Your Down Payment on Investment Properties Technically the minimum down payment for an investment property is 0. On the other hand 64.

Home Mortgages It S A Jungle Out There Home Loan Service

Word Of The Day Down Payment Real Estate Terms Word Of The Day Down Payment

Renting Vs Buying A Home 55 Pros And Cons

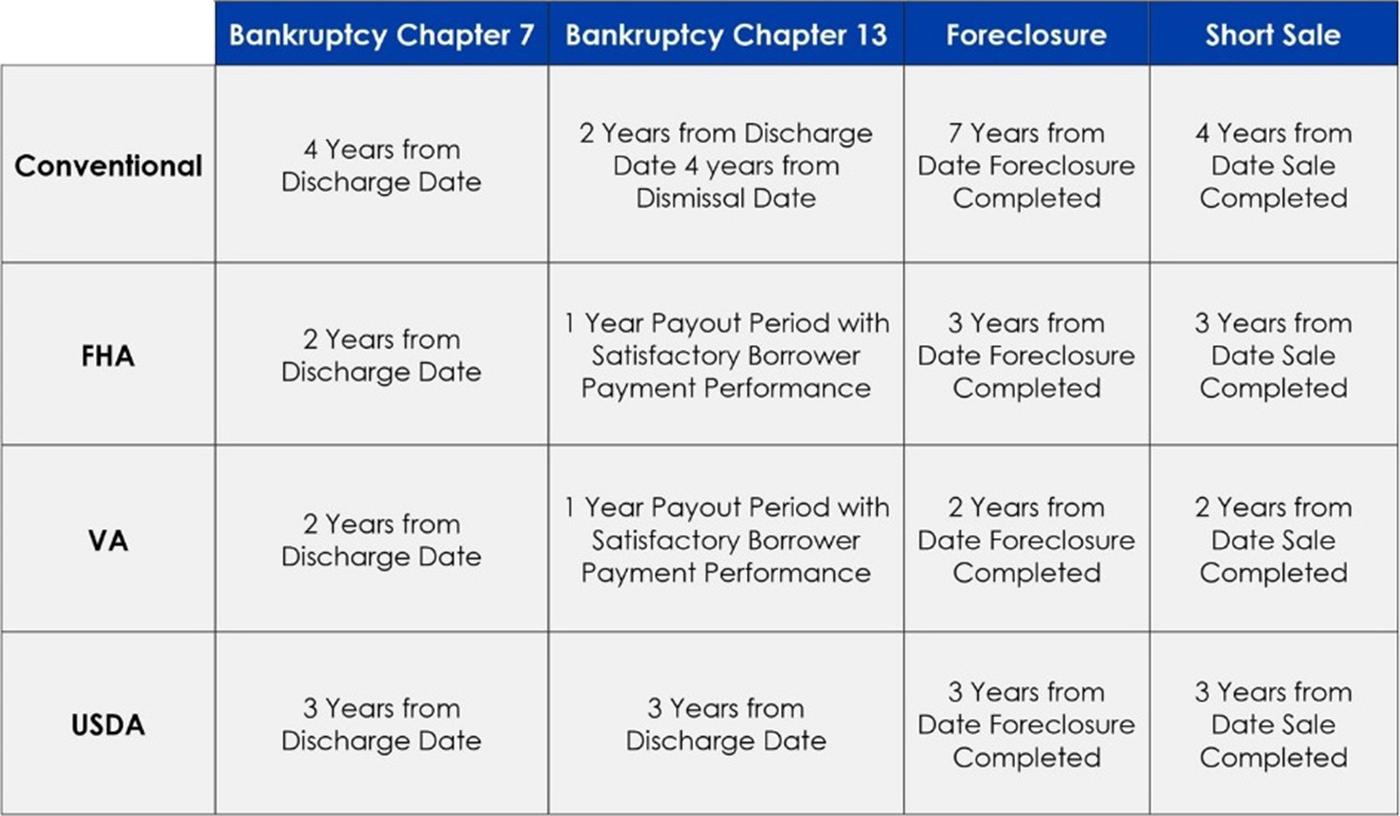

Infographic Down Payment Requirements Lender411 Com Mortgage Loans Mortgage Lenders Real Estate Infographic

The 203 B Fixed Rate Loan Is The Most Popular Fha Home Loan Especially Among First Time Home Buyers If You Fha Loans First Time Home Buyers Buying First Home

Exhibit 99 1

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha

Brendan Pagano Area Sales Manager Nmlsr 366383 Prosperity Home Mortgage Llc Linkedin

Home Mortgages It S A Jungle Out There Home Loan Service

Home Mortgages It S A Jungle Out There Home Loan Service

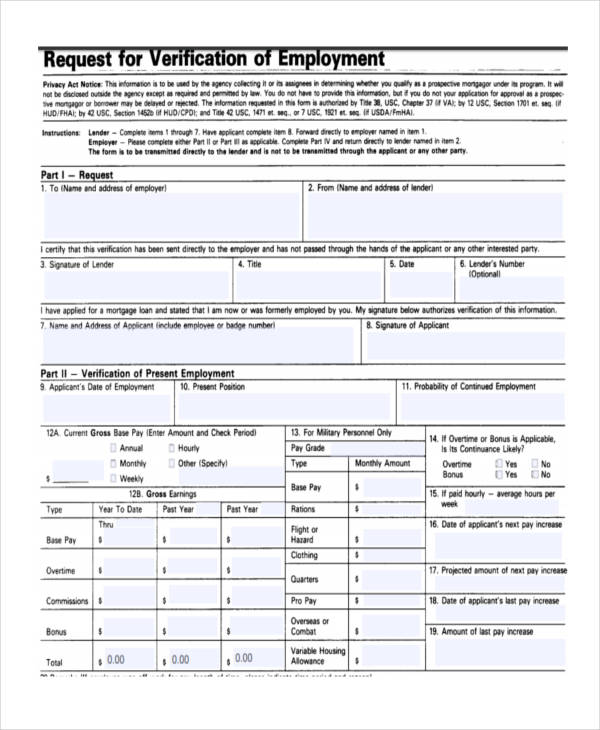

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Mortgage Insurance Who Needs It Buying First Home Home Mortgage Mortgage Tips

Infographic Benefits Of Fha Loans Infographicbee Com Fha Loans Debt To Income Ratio Fha

Esl Mortgage Rates Review By Good Financial Cents

Kris Cedillo Senior Loan Originator Atlantic Home Loans Linkedin

Guild Mortgage Rates Review Good Financial Cents

Charlotte Long Realtor