20+ 403b calculator 2021

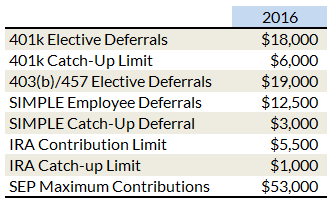

The limit on elective salary deferrals - the most an employee can contribute to a 403b account out of salary - is 20500 in 2022 19500 in 2020 and 2021. Compare that to the 5 per month youve been.

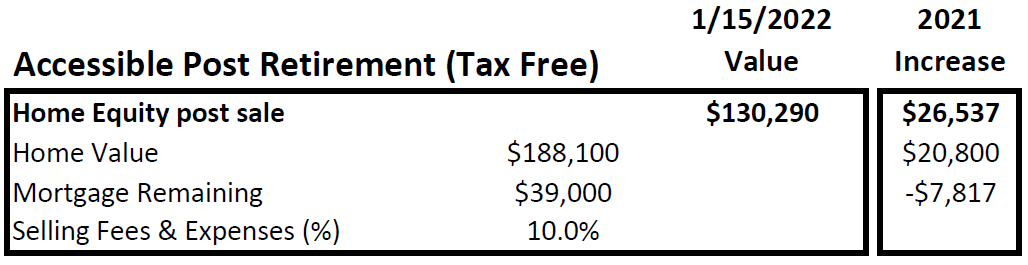

Early Retirement Calculator Spreadsheets Budgets Are Sexy

Estimated annual pre-retirement yield Estimated annual.

. For those who are. We also offer calculators for people. Your annual savings expected rate of return and your current age all.

501c3 Corps including colleges universities schools. Calculate your earnings and more 403b plans are only available for employees of certain non-profit tax-exempt organizations. 5290 Matt Hwy Ste 502 165.

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Helping Achieve Your Financial Well-Being With Courage Strength Wisdom. You can start estimating your RMDs.

Beginning Balance of Account. Ad What Are Your Priorities. Lets say you have a combined 100000 in your tax-deferred retirement accounts.

With Merrill Explore 7 Priorities That May Matter Most To You. Ad Learn How a 403b Can Help Prepare You for a Comfortable Retirement Online Today. Percentage Of Amount Contributed in 403b Plan Employer Match of Contribution 000 100 500 1000 1500 2000 2500 3000 3500 4000.

To pull all of that off youll need to save 2907 every month from now until you retire. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. The annual maximum for 2022 is 20500.

As its name suggests this strategy implies withdrawing a fixed percentage of your account balance each year for example taking out 3. For the 2022 tax year the threshold is anything above an adjusted gross income of 144000 up from 140000 in 2021 for those filing as single or head-of-household. People who have a good estimate of how much they will require a year in retirement can divide this number by 4 to determine the nest egg required to enable their lifestyle.

With Merrill Explore 7 Priorities That May Matter Most To You. If you are over the age of 50 your contribution limit increases to 27000. Based on the table your distribution factor is 283.

Use this calculator to determine how much monthly income your retirement savings may provide you in your retirement. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. It is also important to note.

This 403b calculator can help you whether you need to know how much you should be contributing to your 403b or if you are nearing retirement and want help figuring out how much. This calculator will help you determine your basic salary deferral limit which for 2022 is the lesser of 20500 or 100 of includible compensation reduced by any of. This calculator allows employees to deduct 401 k or 403 b contributions for tax year 2022.

This means you must use the Joint Life and Last Survivor Expectancy table to calculate your RMD. Ad Everything You Need to Know About Planning for Your Retirement. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Thats about 20 of your monthly income. If you are age 50 or over a catch-up provision allows you to contribute an additional 6500 into your 403 b account. 100000 divided by 256 is 390625 which is the.

The IRS elective contribution limit to a 403 b for 2022 starts at 20500. Try Our Calculator Today. We offer payroll calculators for 2017 2018 2019 2020.

Ad What Are Your Priorities. For instance if a. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Dont Wait To Get Started. Planning for Retirement and Benefits Made Easier With The AARP Retirement Calculator. TIAA Can Help You Create A Retirement Plan For Your Future.

This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403 b plan for 2022. Then divide your balance by the distribution period.

General Fi Archives Managing Fi

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Using Roth Retirement Accounts To Avoid Taxes In Retirement Seeking Alpha

Retirement Plans Offered By Amcs Student Doctor Network

Early Retirement Calculator Spreadsheets Budgets Are Sexy

How To Do A Backdoor Roth Ira Step By Step Guide White Coat Investor

Social Security Exemption Archives The Pastor S Wallet

A Friend Of Mine Just Retired As A Civilian Gs15 Working For The United States Navy For 33 Years He Always Brags About His Huge Pension What Kind Of Pension Is He

App Icons Halloween Ienjoyediting

2

2

Early Retirement Calculator Spreadsheets Budgets Are Sexy

How To Do A Backdoor Roth Ira Step By Step Guide White Coat Investor

Early Retirement Calculator Spreadsheets Budgets Are Sexy

2

Using Roth Retirement Accounts To Avoid Taxes In Retirement Seeking Alpha

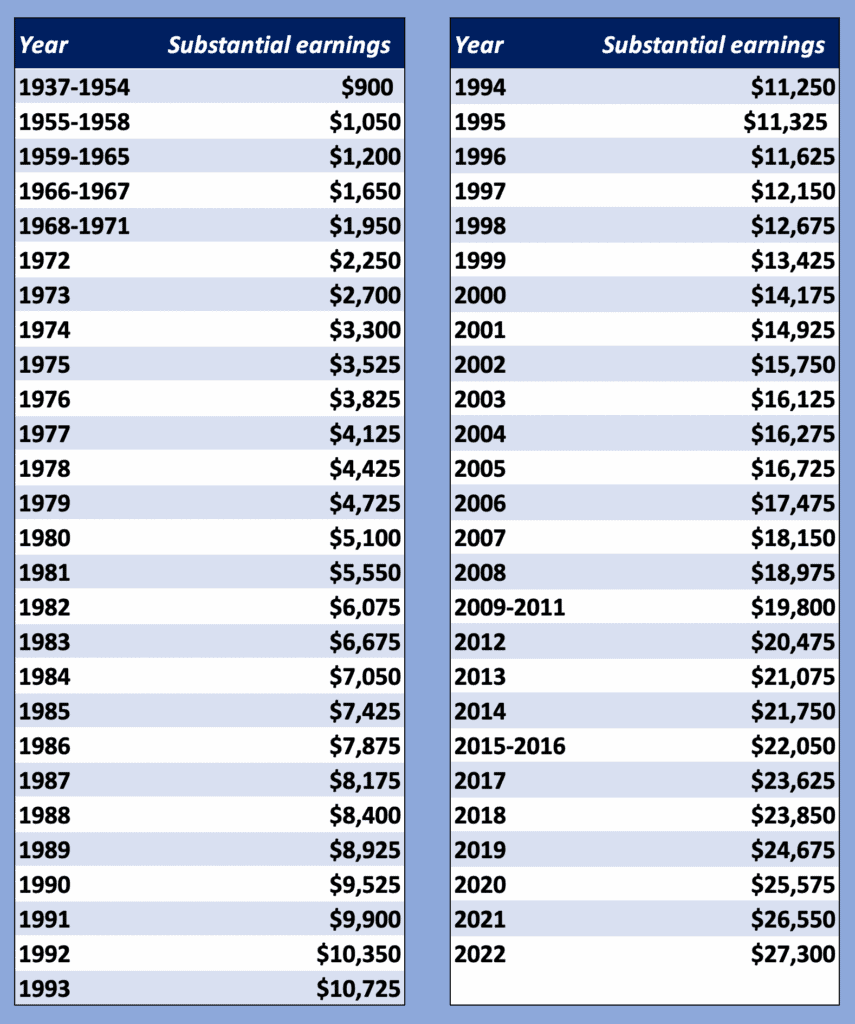

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence